Table of Content

Here in Northeast Florida, it would be approximately 3% of the final price on a financed transaction and 2% on a cash purchase. Discount point equals 1% of the loan amount and typically lowers the interest rate by a quarter of a percentage point. Mortgage amount is calculated by subtracting down payment from the target home price. A minimum down payment may be necessary based on the price of the home. When working with the calculator, please remember the dollar amounts displayed aren’t guaranteed, and what you actually pay may be different. The estimates you receive are for illustrative and educational purposes only.

May include title closing and other charges, including the cost of an attorney. Are fees the lender charges to underwrite and process your loan. Government recording fees are charged by the local government for making a public record of the sale.

Lender's title insurance: N/A

Make sure you understand how much your seller can contribute based on your loan type and request a concession. If you buy a home without an agent, remember to write into your offer letter that you’re proposing a lower rate in exchange for no agent commission. Lender’s title insurance is separate from owner’s title insurance. For example, if you borrow $100,000 to buy your home, your MIP due at closing is $1,750. This upfront payment is separate from your monthly MIP, which ranges from 0.45% to 1.05% of your loan value.

If you're concerned about receiving marketing email from us, you can update your privacy choices anytime in the Privacy and Security area of our website. This information is provided "as-is" and should only be used for general informational purposes. All costs were rounded to the nearest dollar to make the page more legible. Although the cost calculations are believed to be reliable, its accuracy is not warranted in any way.

I. Total Other Costs.

Just be aware that your negotiating power can depend heavily on the type of market you find yourself in. In simple terms, yes – you can roll closing costs into your mortgage, but not all lenders allow you to and the rules can vary depending on the type of mortgage you're getting. If you choose to roll your closing costs into your mortgage, you'll have to pay interest on those costs over the life of your loan. Closing costs can make up about 3% – 6% of the price of the home. This means that if you take out a mortgage worth $200,000, you can expect closing costs to be about $6,000 – $12,000. Ask your LO to provide you a GFE itemizing the loan costs (all closing costs and pre-paid expenses) and your interest rate.

Some of these costs may even be avoidable through negotiation, subsidies, and rebates. If you're selling in the middle of a hot seller's market with low housing inventory, you could ask the buyer to cover some of your closing costs. While closing costs aren't usually the biggest expense for sellers in Kentucky, there are a few ways to reduce these fees. Your realtor will have a better idea of the closing costs you can expect to pay, depending on the Kentucky neighborhood you're selling in and other factors.

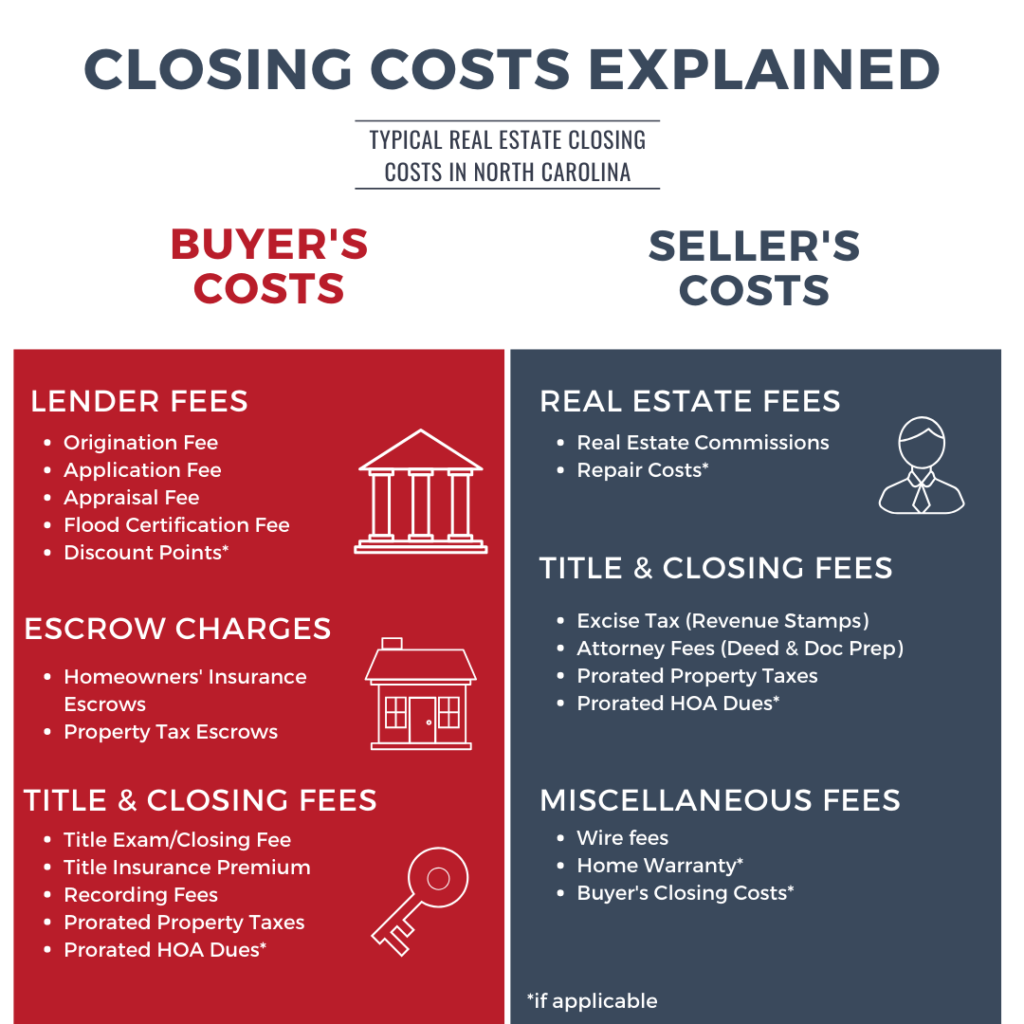

Who Pays Closing Costs?

The content on this site is not intended to provide legal, financial or real estate advice. It is for information purposes only, and any links provided are for the user's convenience. Please seek the services of a legal, accounting or real estate professional prior to any real estate transaction.

The general rule across the country is that home buyers pay the lion's share of closing costs. They can expect to fork over anywhere from 2-5% of the home's sale price, regardless of location. Kentucky closing costs are usually taken right out of your sale profits at closing.

Now if you are doing new construction, there will be higher costs. In 2018, the typical U.S. home spent between 65 and 93 days on the market, from listing to closing. The time a home spends on the market varies greatly depending on local market conditions, demand and seasonality. Time tends to be shorter in the spring and summer months when home buying demand is highest, and longer in fall and winter when demand falls off. This covers collecting your credit report from all three credit bureaus.

Your monthly payment is higher, as is the overall cost of your home loan. You avoid having to pay more upfront at loan closing in addition to your down payment. Covers the amount of interest that will accrue on the mortgage between the date of settlement and the first monthly payment due date. Is for purchasing home insurance, which is typically required by the lender. Is for a policy to protect the lender in case there's an error in the title search and someone makes a claim of ownership on the property after it's sold.

Courier fees cover the cost of transporting mortgage documents. Expect to pay around $30 in courier fees if your lender charges them. At least 3 business days before you attend your closing meeting, your lender will give you a document called your Closing Disclosure.

VA loan closing costs range between 1% and 5% of the total loan amount. The wide range can be attributed to the VA funding fee, which is used in VA loans instead of PMI or MIP. The cost of your funding fee ranges from 0.5% to 3.6% of the total loan cost, depending on a few factors like the type of home you’re buying and if you’ve used VA loan benefits before. Include deposits to start your escrow account, which will be used to cover property taxes, home insurance and, if applicable, private mortgage insurance. Typically you'll deposit enough money to cover two months of these costs. With a no-closing-cost refinance, a lender may offer you lender credits — also called negative points — found in Section J on the second page of your loan estimate.

USDA loan closing costs range from 3% to 6% of the total loan amount. Keep in mind that lenders must adhere to regulations that dictate which closing costs sellers can cover for buyers, and the amount sellers can contribute. Be sure to ask your lender about the specifics of your loan program. Sellers usually pay buyer and listing real estate agent commissions, transfer fees and their own real estate attorney costs.

Closing costs on a mortgage loan usually equal 3 – 6% of your total loan balance. Appraisal fees, attorney’s fees and inspection fees are examples of common closing costs. If you’re buying a home from a family member or friend, you may want to ask them what percentage they paid in property taxes last year.

FHA Mortgage Insurance

Local or county governments charge fees whenever a property changes hands. The seller is usually responsible for covering transfer taxes and recording fees. Sellers may have to pay fees to the county government, state government, both or neither – it all depends on your state. The title insurance company does the title search in most states, while laws dictate that real estate attorneys need to handle title searches in other states.

On average, sellers pay roughly 8% to 10% of the sale price of the home in closing costs — the majority of this cost is made up by agent commissions. Closing costs vary according to many factors, including where you live, but generally range from 2% to 5% of the loan amount. You can shop around to get the best deal on some items, such as home insurance, but you can't control the costs for things like taxes and government fees.

No comments:

Post a Comment